Big Swings That Shape Health Tech Growth

Common bets that can accelerate growth or drain capacity and how to stack the odds in your favor

Why Health Tech Leaders Take These Bets

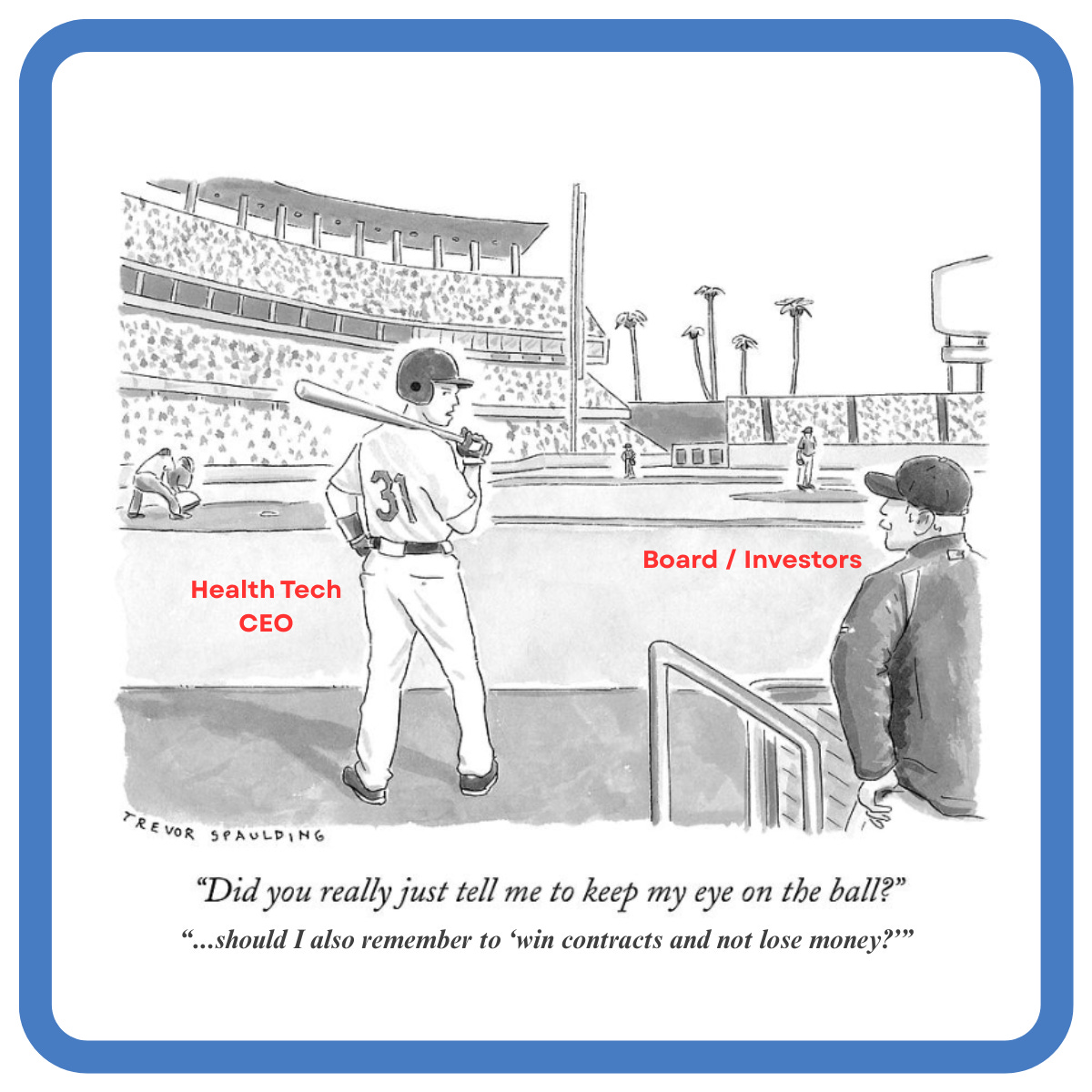

If you sell into health plans, you’ve probably taken on a deal you knew carried more risk than usual. Sometimes those bets deliver exactly what you wanted: a fast expansion, a brand that opens doors, and momentum with investors. Other times, they quietly drain your delivery capacity, delay other launches, and leave you explaining to your board why the numbers aren’t where you said they’d be.

For PE- and VC-backed health tech companies, these decisions are part of the job. The growth curve rarely plays out on safe, evenly spaced contracts. You take calculated swings to secure market position, build credibility, or close a critical revenue gap. The problem isn’t making those moves; rather, it’s going in without the terms, scope, and timelines that prevent them from becoming operational drag.

The Three Drivers Behind Big Swing Deals

Even in well-run organizations, the same three motives come up when leaders choose to bend terms or take on more risk with a health plan. They’re not bad instincts (frankly, some of the best growth stories in the sector started this way), but they can also create deals you’d undo if you had the chance.

Below are three scenarios that represent those motives in action, what can go wrong when selling into payors, and how to keep the upside without inviting the downside.

1. Chasing a Market Beachhead

When entering a segment or geography feels worth bending the terms

The logic:

A plan operates in a segment, geography, or line of business you’ve been trying to enter. Getting in could set up multi-year growth, open access to new buyers, or position you ahead of competitors.

The scenario:

A vendor signed a “low-risk” pilot with a national plan, aiming to expand into multiple lines of business. The pilot required minimal integration and no upfront spend from the plan. Leadership assumed a 90-day success would lead to a multi-million-dollar rollout and built that into forecasts. Within weeks, the plan’s priorities shifted. The pilot stalled, adoption never hit critical mass, and champions became busy with our priorities. The vendor had invested hundreds of hours in a deal that yielded only a fraction of the expected revenue, and now had to explain the shortfall to investors.

How to Protect the Upside:

Scope the pilot to the smallest unit that still proves the outcome you need, so you limit risk while still showing results.

Align metrics to the buyer’s own performance measures so the proof matters inside their organization.

Get the expansion plan reviewed and agreed to by the teams who would execute it before the pilot starts, so buy-in is secured early.

Tie the expansion decision to the buyer’s budget calendar so funding is already in place when it is time to roll out.

2. Landing the Logo That Opens Doors

Leveraging brand credibility as a sales and investor asset

The logic:

Landing a marquee logo will make the next sale easier. It builds credibility with other buyers, signals market validation, and demonstrates your ability to execute at the scale and complexity required for large plans. These factors strengthen your position with investors and in competitive deals.

The scenario:

A tech-enabled service closed a deal with a regional Blue plan, seeing the relationship as a chance to strengthen credibility in the market and open doors with other payors. During contracting, the vendor failed to establish clear reporting requirements with the client. In the first quarter, the plan’s quality team requested weekly custom reports in formats the vendor had never produced. Product and data resources were pulled from a competitive roadmap feature to keep the client satisfied. The detour pushed back a promised release, frustrating existing customers who had been told to expect it months earlier.

How to Protect the Upside:

Decide before entering negotiations what you are willing to trade for the logo, so you stay within clear limits.

If the client requires non-standard work, phase it to keep your core roadmap on track and ensure high-priority features are not delayed.

Capture the logo’s market value early by creating the case study, press release, or RFP reference within the first 90 days.

Have a plan to turn that visibility into pipeline inside a defined time window so the halo effect converts into measurable revenue.

3. Filling a Critical Revenue Gap

Taking terms you wouldn’t usually accept to hit a revenue, investor, or year-end target

The logic:

You need a big win to hit a revenue target, close a quarter strong, or keep momentum with investors. A deal that fits your ICP but requires aggressive pricing or non-standard terms feels worth it to close the gap.

The scenario:

A vendor selling a tech-enabled care management service signed a three-year agreement with a regional plan to help close a competitive quarter. The PMPM rate was discounted to win the bid, and the member ramp would take nine months. The contract’s SLAs, however, applied to the entire eligible population from day one, requiring full staffing and integration immediately. Leadership justified the economics as a short-term trade-off for the quarter’s number. In reality, staggered adoption and the low rate kept the account near break-even for the first year, with no offsetting expansion.

How to Protect the Upside:

Use volume-based price adjustments, shorter initial terms with renewal uplifts, or phased delivery that matches actual uptake so the deal can recover margins over time.

Link the deal to a near-term upsell or cross-sell motion so it is not the only lever driving your target.

Set the expectation with your board or investors that it is a calculated trade-off, so credibility is preserved if the payoff is slower.

Final Thought

These three drivers show up in nearly every health tech growth story. They’re part of how vendors compete for attention in a crowded payor market, and they can accelerate scale when they work. But they can also consume capital, stall the roadmap, and weaken your market position if you don’t set clear conditions before the deal is signed and enforce them when the pressure to “just get it done” is highest.

The companies that navigate these bets well treat them like strategic investments. They know exactly why they’re taking the risk, the specific gain they’re chasing, and the line they won’t cross to get it. In a market where every contract ties up scarce delivery and integration bandwidth, that discipline is the difference between a high-risk deal that becomes a growth milestone and one that becomes a cautionary tale.

If you want to go deeper on the kinds of strategic bets that can define (or derail) your growth, read The 3 Bets That Make or Break Health Tech Growth.

🔒 Like This? Upgrade to a paid Subscription.

The free newsletter covers the big ideas. Paid subscribers get the full breakdowns, including client-tested strategy, behind-the-scenes examples, and deeper thinking you won’t find anywhere else.

→ [Become a Paid Subscriber]

About the Author

Ryan Peterson writes Upward Growth, where he shares practical insights on selling health tech into the payor market. With 15+ years in healthcare growth leadership, he focuses on helping vendors translate their value into traction with health plans.

🟦 Connect with him on LinkedIn.