Breaking Into Medicaid: How Health Tech Vendors Win Beyond Medicare Advantage

How health tech vendors can adapt their sales motion to meet Medicaid’s unique buyers and mandates.

Upward Growth provides health tech leaders with the playbooks and proof to transform complex markets into real growth. Each week, we deliver clear, practical strategies on positioning, messaging, and growth, so leaders can close enterprise deals and build repeatable momentum.

🤝 Work with Ryan on payor growth strategy: Contact me

🟦 Connect with the author, Ryan Peterson, on LinkedIn.

💡 Newsletter sponsorships are available: Learn More

Several subscribers have recently asked me about breaking into Medicaid, prompting this article. Even if Medicaid isn’t on your roadmap today (or perhaps you already sell to Medicaid plans), there’s plenty in this piece to apply more broadly. Think of it as a guide to expansion strategy and proof-building, with lessons you can apply across growth motions.

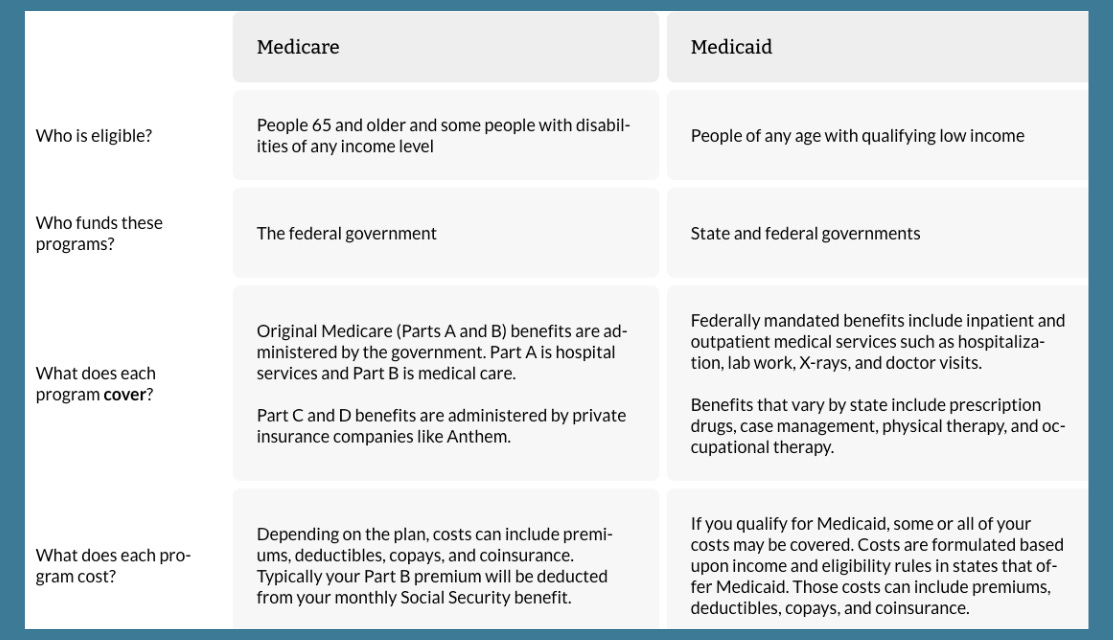

Most CEOs with momentum in Medicare Advantage eventually hear the same suggestion from their board or investors: “It’s time to expand into Medicaid.” At first glance, the logic is tidy. Both are government programs. Both involve health plans. Both touch populations that need interventions vendors already provide.

However, Medicaid is not Medicare Advantage on a different scale. The governance is different. The incentives are different. The buying process is different. The real cost isn’t just lost deals. It’s the erosion of focus. Leaders burn time on the wrong pursuits, core clients start to sense distraction, and the growth engine that worked in MA begins to slow.

This post isn’t here to walk through Medicaid’s history, unpack the “One Big, Beautiful Bill” Medicaid cuts, or get lost in waiver mechanics. Instead, what follows is a practical guide for vendors: how to avoid the traps that stall most Medicaid entries and how to structure your first moves so they build proof instead of distraction.

For vendors willing to reset their assumptions, Medicaid can be a legitimate growth channel. However, it only works if leaders acknowledge the structural gap between what they’ve built for MA and what Medicaid actually requires.

The Deceptive Similarities: Why Medicaid Isn’t Just Another MA Market

The parallels explain why so many health tech vendors underestimate the shift. Both programs are administered by health plans. Both require outcomes at scale. Both have complex compliance requirements. If you have proof in Stars or risk adjustment, it feels natural to assume those same successes will persuade Medicaid buyers.

That’s where expansion efforts start to break.

Medicaid is controlled by states. Contracts flow through budgets, legislatures, and waiver politics. Timelines aren’t measured in quarters; they often stretch into multi-year cycles defined by procurement calendars. In many states, your “buyer” isn’t really a health plan executive, so much as a public RFP committee.

The economic frame also shifts. Medicare Advantage pays for interventions that grow premium revenue or protect bonuses. Medicaid prioritizes cost avoidance, access expansion, and equity mandates. The math doesn’t neatly translate. A Stars case study may be impressive to your MA clients, but it’s irrelevant to evaluators focused on maternal health, behavioral carve-ins, or social determinants.

This isn’t a matter of tweaking slides or rewording case studies. The gap is structural, and vendors who ignore it waste years pursuing RFPs they were never equipped to win.

The Missteps Vendors Make Entering Medicaid

Boards push for Medicaid because the market size looks irresistible. The problem isn’t a lack of effort, but rather vendors stepping in with the wrong playbook. They assume the same proof, geography, and references that worked in MA should translate. They don’t. And the result is sales teams spinning their wheels while core clients sense drift.

The most common mistakes fall into four patterns worth examining more closely:

Copy-paste proof. Vendors lean on Stars or risk-adjustment case studies that hold little value for Medicaid evaluators. The result is a mismatch between what they’re selling and what buyers are scored on.

Spray-and-pray geography. Instead of starting out by focusing on one state, leadership greenlights outreach across five or six. Sales reps chase scattered RFPs, never building the depth of credibility or relationships needed to actually land one.

No local anchor. National plan references may impress in MA, but in Medicaid, state evaluators want to see trusted names: FQHCs, community clinics, and advocacy groups. Without those partners, every meeting starts with vendors proving they even belong.

Distraction creep. Even when deals don’t land, the pursuit eats bandwidth. Core MA clients sense the shift in focus and start to wonder whether the vendor is still fully committed to the outcomes that built the relationship in the first place.

Vendors can burn years chasing Medicaid opportunities they were never positioned to win. Medicaid plans don’t reward recycled proof, they don’t trust outsiders without local anchors, and they don’t move fast enough for you to recover once credibility slips. What they do expect are vendors who show up aligned to their mandates, fluent in their processes, and grounded in their communities.

What Medicaid Buyers Actually Expect from Vendors

If the common missteps reveal where vendors stumble, the counterweight is clear: Medicaid plans reward vendors who come prepared to address their priorities, rather than learning on the fly. That means aligning with mandates written into contracts, proving outcomes within the state’s own reporting framework, and demonstrating credibility through local partners who already have established trust.

Three capabilities, more than any product feature, separate the vendors that actually win traction:

Policy and Procurement Discipline. Medicaid plans operate under rules set by the state, and every decision is filtered through that lens. Winning requires more than sales skill; it also takes government affairs expertise, knowledge of waiver priorities, and patience for procurement cycles that can span years.

Medicaid-Native Partnerships. Medicaid plans don’t just want software and service solutions. They want partners who can demonstrate local credibility. That means having ties to behavioral health networks, local clinics, or advocacy groups that serve the very members the plans are accountable for.

Reframed Proof and Messaging. MA case studies rarely translate. Medicaid plan buyers require evidence that addresses their mandates, specifically the impact on cost avoidance, access expansion, and health equity. Messaging must shift, too. Your focus is less on protecting plan revenue and far more on demonstrating how you help the plan meet the public health goals it is contracted to deliver for the state.

The vendors that gain traction are deliberate and well-prepared. They demonstrate how their solutions align with Medicaid plans' state contract obligations, package proof that executives can confidently stand behind during compliance reviews, and reinforce credibility through community partners the plan already trusts.

Knowing what Medicaid plans look for is only half the battle. The real question is whether you’re positioned to show up with those capabilities today.

How to Know If You’re Ready to Enter Medicaid

Every CEO hears the suggestion to “go after Medicaid.” But before you take the bait, these five questions are the real litmus test. If you can’t answer yes, hold back until you can. It will save you years of wasted cycles.

Can you name the one state where you’d anchor first, and why that market is winnable?

In that state, do you have a local clinic, FQHC, or advocacy group whose name Medicaid plan leaders already trust?

Do you know the single mandate you’d align to, the metric or waiver deliverable you’d measure against?

Could you show Medicaid-specific proof tomorrow, not just recycled MA numbers?

Do you have dedicated capacity (a team, not a side project) to run the motion without bleeding focus from MA?

If the answer isn’t yes, that’s fine. Waiting until you’re ready is smarter than burning two years on unwinnable pursuits. Medicaid rewards discipline, and vendors who build the right foundation are the ones who successfully make this expansion.

Upgrade to a paid subscription to keep reading — including a full mock case study of a vendor’s failed Medicaid entry, the step-by-step blueprint for getting it right, and a practical guide on how to turn a single pilot into durable proof that wins contracts.