CMS Dropped 465 Pages. Here's What Matters for Your Next Health Plan Call.

Your buyer's regulatory team already flagged the key sections. If you're selling to MA plans and don't know what's in here, you're walking into calls blind.

Upward Growth provides health tech leaders with the playbooks and proof to transform complex markets into real growth. Each week, we deliver clear, practical strategies on positioning, messaging, and growth, so leaders can close enterprise deals and build repeatable momentum.

🤝 Work with Ryan on payor growth strategy: Contact me

🟦 Connect with the author, Ryan Peterson, on LinkedIn.

💡 Newsletter sponsorships are available: Learn More

Today’s Upward Growth is brought to you by… Superpower

Superpower is a health intelligence platform that helps you achieve the best health of your life.

They decode 100+ biomarkers, screen for 1000+ conditions, and deliver a personalized health protocol supported by a 24/7 clinical team for $199/year.

Each member also gets an AI companion that removes complexity and makes building durable habits easy.

93% of members say it beats any primary care experience they’ve ever had.

Superpower is offering free memberships to Upward Growth readers who are founders, executives, and people leaders exploring new ways to improve health, performance, and well-being within their organizations.

CMS released the Contract Year 2027 proposed rule on November 28, 2025. It’s 465 pages covering Medicare Advantage, Part D, and Medicare Cost Plans, touching everything from Stars methodology to risk adjustment to SNP oversight. (Full proposed rule here.)

I went through all 465 pages looking for the signals that will change how health plans buy, what they prioritize, and where they’re likely to increase or cut investment. Most of the document is technical updates and routine codification. However, buried within are six signals that will directly impact your sales conversations, product positioning, and 2027 forecast. These are the ones your buyers will be reacting to, whether or not they tell you directly.

What is this thing? CMS releases proposed rules annually that set the framework for how plans will operate, get paid, and be measured. This one covers Contract Year 2027. It’s a mix of actual policy changes (some codifying existing policies) and Requests for Information (RFIs) signaling where CMS is headed next. The RFIs matter as much as the rules, as they tell you what’s coming even if it’s not locked in yet.

Why should you care? Your buyer’s regulatory and clinical teams are already working through it. What they flag will shape what plans prioritize, where they spend, and what they’re willing to buy in 2027. Here’s the thing: health plan executives aren’t sitting around talking about your product. They’re talking about this document. They’re discussing what CMS just signaled, what it means for their Star ratings, their risk adjustment revenue, and their compliance exposure. If you want their attention, you need to speak to what’s already on their mind.

Key Dates

Published: November 28, 2025

Comments due: January 26, 2026

Final rule expected: April 2026

Applies to: Contract Year 2027

Signal 1: The Health Equity Index Is Dead

This one has political history! In February 2022, the Biden administration proposed adding a Health Equity Index (HEI) to the Star Ratings program. The idea: create a financial incentive for plans that delivered strong outcomes for underserved populations, specifically beneficiaries who are dually eligible for Medicare and Medicaid, receive a low-income subsidy, or have a disability.

CMS finalized the HEI in the April 2023 final rule, with implementation set for the 2027 Star Ratings. The HEI would replace the existing “reward factor” that gave bonus points to plans with consistently high performance. Under the Trump administration, the HEI was renamed “Excellent Health Outcomes for All” (EHO4all), but that turned out to be a name change only, not a policy shift, as was highly anticipated.

Now, CMS is proposing not to move forward with implementing the HEI/EHO4all reward at all. Instead, they’re keeping the historical reward factor that the HEI was designed to replace. The estimated impact: $13.18 billion over the next ten years, flowing differently than originally planned.

Some plans (and vendors) built infrastructure specifically expecting this incentive, and now they’re recalculating. Plans that invested in health equity capabilities, expecting a discrete bonus, are rethinking the ROI case. Health equity still matters operationally, but the explicit financial reward structure isn’t happening.

This doesn’t mean plans will abandon health equity work. It means the conversation shifts from “invest here to earn the HEI bonus” to “invest here to close gaps that affect Stars measures, improve risk adjustment accuracy, and avoid downstream penalties.”

Bottom line: If you pitched “help plans earn the HEI bonus,” that positioning is dead.

The question now: does your value prop hold without that discrete incentive? If yes, reframe around operational value (gap closure, risk adjustment accuracy, churn reduction). If your entire story was built around HEI bonus capture, you have a positioning problem. Health plans that shrug this off weren’t banking on HEI anyway, which tells you their health equity investments were already tied to other value drivers.

Signal 2: Risk Adjustment and Quality Bonus Payments: Big Questions, No Answers Yet

Signal 1 is about something that’s not happening. This one is about something that might, and nobody knows what it’ll look like.

CMS included a major RFI on “future directions” for the MA program, specifically asking for input on risk adjustment and quality bonus payment structure.

The language is significant. CMS explicitly states that the current risk adjustment system “may disadvantage smaller, newer, and less well-resourced plans” and “may encourage plans to prioritize investment in coding activities that could lead to MA plans coding more intensely than Original Medicare.”

They’re asking whether changes should come through regulation or through a CMMI model. And they’re exploring specific directions:

A “next-generation risk adjustment model” that could use AI and alternative data sources

Ways to streamline the quality measurement timeline (currently, there’s a two-year lag between measurement and payment)

Changes that would “level the playing field for smaller, regional, and less well-resourced MA plans”

Nothing is decided yet, and CMS is openly asking stakeholders what the payment structure should look like going forward, but the direction is clear. They’re looking at structural changes that could reshape competitive dynamics between national and regional plans.

For plans, the questions are immediate: How will this affect our revenue? How do we budget when CMS is openly asking what to do with the payment model? Plans that rely heavily on current risk adjustment economics, particularly those with sophisticated coding operations, are watching this closely.

Bottom line: Uncertainty is the story. Plans are building 2027 budgets with a major question mark over payment structure.

If your value prop is helping large national plans maximize risk adjustment revenue under the current model, that’s now a riskier bet. The RFI signals potential changes to how those plans get paid, and they know it. Smaller regional plans, on the other hand, could benefit if the policy shifts as they’re less exposed to the current model’s advantages being unwound.

The safer play, regardless of your customer mix: sell solutions that improve fundamentals like documentation quality, care coordination, and outcomes. Those hold value no matter which direction CMS goes. Bets on specific payment mechanics are now bets on regulatory continuity.

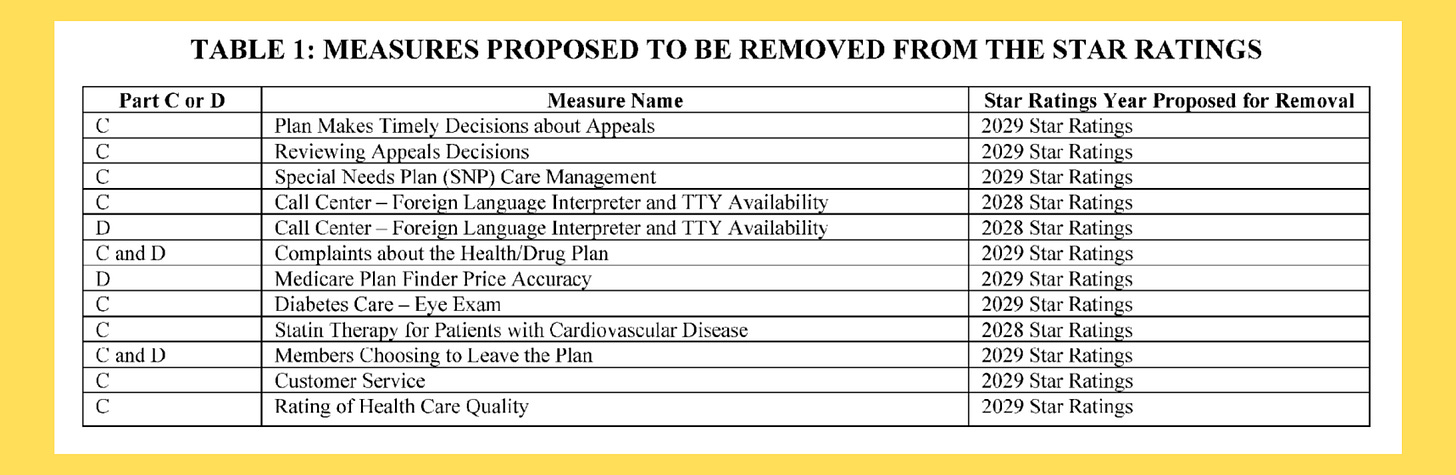

Signal 3: Star Ratings Simplification: 12 Measures on the Chopping Block

The first two signals are about money: how plans get rewarded and how they get paid. This one is about what they get measured on.

CMS is proposing to “simplify and refocus” the Star Ratings measure set by removing 12 measures. The stated goal: reduce administrative burden and focus on clinical care, outcomes, and patient experience where there’s meaningful variation across contracts.

The 12 measures proposed for removal are mostly administrative and process-focused:

Most of these won’t be removed until the 2028 or 2029 Star Ratings, giving plans time to adjust.

CMS is keeping measures focused on clinical care, health outcomes, and patient experience. They’re also adding a new Depression Screening and Follow-Up measure starting with the 2027 measurement year (reflected in 2029 Star Ratings).

The measures being cut are ones where performance is already high across the industry. They weren’t differentiating plans anyway. But plans still need to figure out where to redirect resources, and they’re waiting for the final rule before making big moves.

Bottom line: Check if your value prop ties to any of the 12 removed measures. If your solution is single-threaded to one of them, you have a positioning problem that needs to be addressed before the final rule drops. Clinical and outcomes-focused solutions become relatively more important as administrative measures drop out.

Signal 4: C-SNP Dual Enrollment Is Under Scrutiny

If your buyers operate Special Needs Plans, particularly Chronic Condition SNPs (C-SNPs), this signal matters. CMS is concerned that some plans are using C-SNPs to enroll dual-eligible members who would otherwise be subject to stricter D-SNP requirements. In other words, they think some plans are gaming the structure. The language in this RFI is pointed, and if your solution touches SNP enrollment, retention, or member routing, you need to understand where CMS is drawing the line.

This matters because D-SNPs have more stringent requirements around integrating Medicare and Medicaid benefits. C-SNPs, while valuable for members with specific chronic conditions, weren’t designed to serve as the primary vehicle for duals.

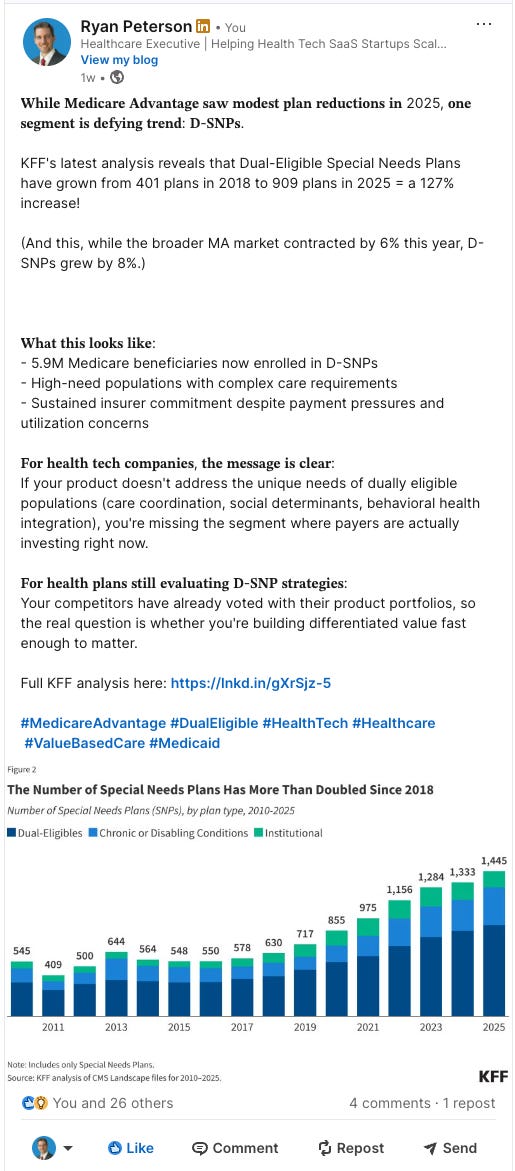

The numbers tell the story. D-SNPs have grown substantially, from 401 plans in 2018 to 909 in 2025. But C-SNPs have nearly tripled in the same period, from 132 plans to 376. The RFI suggests CMS is watching whether some of that C-SNP growth represents duals being steered away from D-SNPs.

Health plans with significant dual enrollment in C-SNPs are asking: Are we exposed? Will CMS force us to move members to D-SNPs? What’s our SNP strategy going forward?

This is an RFI, not a rule change, but it signals that future regulation is likely coming. Plans with significant dual enrollment in C-SNPs are likely getting questions from their compliance teams right now.

Bottom line: D-SNP integration capabilities just became more valuable. If your solution helps plans work around D-SNP requirements through C-SNPs, you’re on the wrong side of where CMS is pointing. If you help plans serve duals compliantly through D-SNP structures, your case just got stronger. Plans that aren’t concerned either don’t have significant dual enrollment in C-SNPs, or their strategy was already D-SNP-focused.

Signal 5: CMS Is Asking About Deregulation

Every vendor selling compliance, reporting, or administrative solutions should pay attention to this one. CMS is asking plans which requirements are burdensome and could be simplified or eliminated. If you help plans meet a requirement that ends up on the chopping block, your value prop changes overnight.

Consistent with the Administration’s deregulation priorities (specifically Executive Order 14192), CMS is seeking comments on simplifying requirements across several areas:

Network adequacy: Simplifying the provider network review process, including a potential new “pattern of care” exception

MLR reporting: Streamlining medical loss ratio requirements

Supplemental benefit utilization reporting: Reducing data elements that plans must report on how members use supplemental benefits

SNP model of care requirements: Simplifying documentation requirements for Special Needs Plans

CMS is also asking how AI could enhance beneficiary decision support tools, signaling openness to technology-enabled approaches.

For plans, the questions are immediate: Are we finally getting relief from reporting burdens? Which requirements might actually relax? Should we hold off on compliance investments in areas where rules might change?

Bottom line: This is a “watch this space” signal, not an action item. If your solution helps plans meet reporting requirements that could get eliminated, understand which ones are on the table. Budget freed up from compliance overhead will shift somewhere (Hint: position your org to capture it). If plans seem dismissive, they either have an efficient reporting infrastructure already or they’re skeptical that anything will actually change. After all, deregulation RFIs don’t always turn into deregulation.

Signal 6: Part D Economics Are Now Permanent

If you’ve been following Part D changes over the past year, nothing in this section is new. But don’t skip it. CMS is codifying the IRA-driven Part D redesign into permanent regulation, which means these aren’t temporary policies that might revert; they’re the new baseline. If your solution touches pharmacy costs, medication adherence, or Part D plan economics, the market you’re selling into just got locked in.

The rule makes permanent the changes already in effect: the $2,000 out-of-pocket cap (adjusted to $2,100 for 2026), the eliminated coverage gap, the Manufacturer Discount Program, and increased plan sponsor liability in the catastrophic phase. Plans are no longer treating these as temporary policy or waiting for a reversal. They’re rebuilding their economics around them.

That means Part D margins are under sustained pressure (and will stay that way), as health plans need to manage pharmacy costs more aggressively than before. And Medication adherence matters more when the plan carries more risk in the catastrophic phase.

Bottom line: Part D margin pressure is permanent, not temporary. If your solution touches pharmacy costs or adherence, you have tailwinds. Lead with the ROI case showing cost savings and downstream cost prevention. If Part D isn’t top of mind for a buyer, it’s either not a major line of business for them or they’ve already adjusted their operations.

Final Thought

Six signals, one theme: uncertainty.

Plans that invested in health equity infrastructure for the HEI bonus are recalculating. Plans that built margin assumptions around current risk adjustment economics are stress-testing scenarios. Across the board, your buyers are processing what this proposed rule means for their 2027 strategy (and they don’t have answers yet either).

You don’t need to have answers. But you need to know the questions are being asked.

If you’re mid-deal and your buyer suddenly has new hesitation or wants to revisit timelines, now you know why. If you want to show you understand what’s going on, try questions like:

“How’s your team thinking about the proposed rule and what it means for your Stars strategy?”

“With the Health Equity Index not moving forward, how are you approaching health equity investments now?”

“What’s your read on where risk adjustment is headed?”

These aren’t gotcha questions. They’re invitations for your buyer to tell you what’s actually on their mind. And when they do, you’ll be ready, because you understood what was in those 465 pages before you walked in.

Click the button above to get your personal referral link. When 3 people subscribe using your link, I’ll email you the Tactial Toolkit.

Join the convo on Linkedin:

https://www.linkedin.com/posts/ryan-peterson-1a20866_healthtech-medicareadvantage-healthplans-activity-7401673623851487232-iOV2