Five Health Tech Trends I Tracked in 2025: The Year-End Scorecard

An honest look at what I got right, what I missed, and what it revealed about buyer behavior.

Upward Growth provides health tech leaders with the playbooks and proof to transform complex markets into real growth. Each week, we deliver clear, practical strategies on positioning, messaging, and growth, so leaders can close enterprise deals and build repeatable momentum.

🤝 Work with Ryan on payor growth strategy: Contact me

🟦 Connect with the author, Ryan Peterson, on LinkedIn.

💡 Newsletter sponsorships are available: Learn More

Today’s Upward Growth is brought to you by… Superpower

Superpower is a health intelligence benefit that catches problems before they become claims.

Members get advanced 100+ biomarker testing, screening for 1000+ conditions, and a on-demand clinical team that actually tells them what to do - not just what’s wrong.

93% of our members say that they’ve found the experience “life-changing.”

The result? Healthier employees who cost less to insure and stay longer.

Superpower is offering a free trial to Upward Growth readers who want to explore a smarter approach to employee health.

Book a Demo to explore Superpower for Your Organization

A year ago, I published five healthcare trends to watch in 2025, based on shifts I was seeing in real conversations with health plan buyers, patterns emerging from dozens of sales cycles, and signals I thought would define how health tech companies win (or lose) deals in the year ahead.

I wrote an article on each one throughout January 2025, highlighting what vendors, investors, and health plans should focus on as they navigate the following areas:

1. Data security as a competitive advantage

2. Interoperability as a backbone

3. Advanced risk stratification and predictive analytics

4. Social determinants of health (SDoH)

5. Value-based care driving innovation

Now it’s December, and I owe you a scorecard.

This isn’t a comprehensive recap of everything that happened in health tech this year (that would be a book, not an article). Instead, I’m revisiting each trend with a few key highlights that either validated the direction I was tracking or forced me to rethink the thesis entirely.

As you can imagine, some landed exactly how I expected. Others played out differently than I anticipated. And regulatory shifts entirely reversed one I didn’t see coming, which was a strong reminder that in healthcare, CMS can change the game overnight.

So here’s the honest assessment: what held up, what didn’t, and more importantly, what each trend revealed about where health plan buying behavior is actually headed in 2026.

Trend 1: Data Security Becomes a Competitive Advantage

What I said: Data security would shift from a compliance checkbox to a competitive differentiator. Plans and vendors who led on security would build trust and win business.

What actually happened: 2025 proved it. Not just because the breach environment stayed brutal (the first half of 2025 alone saw major breaches at Yale New Haven, DaVita, Frederick Health, and McLaren), but because buyer behavior actually changed.

A Ponemon Institute study found 44% of healthcare organizations experienced a third-party breach in the past 12 months. After Change Healthcare exposed the risk of single-vendor concentration, buyers began asking different questions. Not “show me your SOC 2,” but “what happens to my operations if you go down?” KLAS research confirms third-party risk management is now the top cybersecurity investment priority for healthcare organizations over the next two years.

HITRUST certification became table stakes. If you’re selling to health plans or provider organizations without it, you’re frankly starting the conversation at a disadvantage. HITRUST’s data show that fewer than 1% of certified organizations reported breaches in the past two years.

In June 2025, the FDA issued final guidance on medical device cybersecurity, clarifying that if your device contains software, cybersecurity requirements apply. No more arguing your product doesn’t qualify as a “cyber device.” This changes procurement conversations for any vendor touching clinical workflows.

Verdict: ✅ Right, and buyers have changed how they are selecting vendors.

What this means for 2026: Security isn’t just table stakes for survival. It’s a sales accelerator for vendors who can prove it. The vendors winning deals in 2025 weren’t just avoiding breaches. They leveraged certifications and a documented security posture to shorten sales cycles and displace competitors unable to offer the same assurances.

Trend 2: Data Interoperability Becomes the Backbone of Healthcare

What I said: CMS regulations would force the industry to prioritize interoperability. The winners wouldn’t be organizations that simply moved data across the ecosystem. And the competitive advantage would come from making sense of fragmented, unstructured information and turning it into actionable insights.

What actually happened: The regulatory push continued, but a voluntary industry movement surprised me.

TEFCA has expanded significantly, and eleven data exchanges now hold Qualified Health Information Network status, more than double the number when TEFCA went live in late 2023. CMS finalized rules requiring payers to implement FHIR APIs for prior authorization by January 2026 and additional APIs by January 2027.

But the bigger story was the Trump administration’s “Making Health Tech Great Again” initiative in July 2025. More than 60 providers, payers, and software companies made voluntary commitments to a new CMS Interoperability Framework. The framing from CMS was explicit: “This is a movement, not a mandate. It is a call to action, not a regulation.” There was plenty of debate about which organizations were (or weren’t) included from the industry, but for now, the focus should be on the initiative and CMS's stance, as it’s a meaningful shift in how interoperability is advancing (voluntary alignment vs. regulatory mandate) and signals how this administration approaches healthcare technology policy.

Verdict: ✅ Right on the direction (but honestly surprised by the mechanism).

What this means for 2026: Vendors positioned around “CMS requires this” have a weaker story than those positioned around “this is where the industry is moving, regardless of regulation.” The interoperability conversation is shifting from compliance deadlines to operational efficiency and competitive advantage.

Trend 3: Advanced Risk Stratification and Predictive Analytics

What I said: AI and machine learning were becoming table stakes, but the real value would come from how health plans and vendors used these tools to identify risks, prevent costly interventions, and improve outcomes. I warned that AI was being commoditized by loud marketing with little application (more on this near the end of the article).

What actually happened: The investment thesis played out, and my commoditization warning proved accurate.

Healthcare AI spending hit $1.4 billion in 2025, nearly tripling 2024’s investment, according to Menlo Ventures’ annual State of AI in Healthcare report. The industry is now deploying AI at more than twice the rate of the broader economy, with 22% of healthcare organizations implementing domain-specific AI tools (a 7x increase over 2024).

But here’s what matters: the dollars are flowing to specific categories with measurable ROI, not to generic “AI-powered” platforms. Ambient clinical documentation captured $600 million (reducing physician burnout), and coding and billing automation captured $450 million (recovering revenue lost to errors and denials). Prior authorization automation grew 10x year over year. These aren’t moonshot bets. They’re solutions to operational pain points that CFOs can quantify.

Abridge is a good example of what this looks like in practice. They raised $550 million across two rounds in 2025, bringing their valuation to $5.3 billion. But the number investors are watching isn’t the fundraising, it’s that over 90% of clinicians who start using their platform continue using it. Retention, not the underlying technology, is what’s driving the valuation.

The common thread? These companies aren’t selling AI. They’re selling time back to clinicians, faster clean claim rates, and more accurate risk capture. The AI is the engine, not the product.

Meanwhile, the market remains flooded with “AI-powered” claims that don’t address the problems they’re meant to solve. For every company with real traction, there are a dozen pitching vaporware wrapped in buzzwords. More on this below.

Verdict: ✅ Right.

What this means for 2026: The practical AI companies (ambient documentation, revenue cycle automation, care management workflows) are pulling away from the “AI for AI’s sake” crowd. If your pitch deck has “AI-powered” on the cover and outcomes data is not front and center, you have it backwards. Plans are buying solutions to problems, not technology for technology’s sake. Lead with the problem solved and the outcomes documented. Bury the AI jargon.

Trend 4: Addressing Health Equity Through Social Determinants of Health

What I said: Health plans would embrace SDoH as a core strategy, driven by the financial reality that unaddressed social factors drive avoidable utilization. CMS was pushing screening requirements, new reimbursement models, and data-sharing initiatives. The organizations that moved beyond screening to intervention would lead.

What actually happened: The need for addressing social determinants hasn’t gone anywhere. If anything, it’s more urgent than ever. But the regulatory momentum I was counting on? CMS reversed course.

There was some movement. CMS increased severity-level designations for inpatient encounters with housing insecurity Z-codes, resulting in higher reimbursement for plans serving members with documented social needs. But that was the exception, not the rule.

The broader regulatory momentum I expected didn’t materialize. CMS proposed significant rollbacks to SDoH and equity-related reporting requirements across inpatient settings, framed as reducing provider burden. Four SDoH-related quality measures will become optional in 2025 and phased out entirely by 2028. The Health Equity Index (also known as EHO4all), which would have created explicit financial incentives for plans serving underserved populations, was scrapped in the CY2027 Proposed Rule.

Verdict: ❌ Wrong. I did not see the regulatory reversal happening this year. (I assumed the renaming of HEI to EHO4all was the only change that would occur.)

What this means for 2026: Vendors whose SDoH pitch centers on “CMS requires this” are repositioning. Vendors who built around “this reduces readmissions and protects margin” are better off. And at least in the short term, the compliance-driven buyer for SDoH solutions has largely disappeared (the ROI-driven buyer didn’t). That changes who you’re selling to (finance and medical economics teams, not just quality and compliance) and how you position (cost avoidance and outcomes, not regulatory checkbox). If your SDoH value prop was anchored to the Health Equity Index bonus, you need a new story fast.

Trend 5: Value-Based Care Drives Innovation

What I said: Value-based Care (VBC) would reach a critical turning point, with CMS and payors accelerating the shift to address a growing and aging population with fewer resources. The real winners would be those who operationalized VBC effectively, not just participated in programs.

What actually happened: The momentum continued and accelerated.

As of January 2025, 53.4% of people with Traditional Medicare are in an accountable care relationship with a provider. 14% of nationwide provider reimbursement is now tied to delegated or capitated risk models, double from three years prior. Over 60% of health organizations surveyed expect higher VBC revenue this year.

The Hinge Health and Omada Health IPOs validated that outcomes-based, tech-enabled care models can reach public markets. Hinge opened 23% above its IPO price. Omada opened 21% above. Both companies spent over a decade building clinical evidence and operational maturity before going public.

Verdict: ✅ Right.

What this means for 2026: VBC is no longer optional or experimental. The math will continue to force it. But the vendors winning aren’t promising to “enable value-based care.” They’re showing documented cost savings in current contract years, not projections dependent on future Stars bonuses or risk adjustment settlements. CFOs are funding certainty, not potential. If your ROI story requires waiting 18 months for a Stars bonus to show returns, you’re losing to competitors who can demonstrate impact in the current contract year.

A Note on AI: Why It Wasn’t a Standalone Trend

You’ll notice AI wasn’t one of my five trends. That was intentional, and perhaps the most significant misunderstanding I’m seeing in our industry.

AI is a tool, not a product. It’s a capability that can accelerate everything I wrote about (security, interoperability, risk stratification, SDoH, VBC), but it’s not a category unto itself. Companies treating AI as the headline rather than the capability are losing positioning ground to competitors who lead with outcomes.

I recently spoke with an investor at a massive firm about the AI landscape in health tech. I told him, “I’ve never seen a bleeding-edge innovation become commoditized faster than AI has. I mean, everyone says they use AI, but few are talking about the problem they’re now solving better or faster because of it.”

He agreed immediately that he sees countless pitches weekly, ranging from Stealth-mode companies to Series C health tech orgs. And that’s a big issue.

When every vendor claims “AI-powered,” the term means nothing. It’s table stakes, not differentiation. The massive missed opportunity is that most vendors are talking about the road (AI) when they should be talking about the destination (reduced clinician burnout, faster prior auth, fewer readmissions, better gap closure).

Look at the companies actually winning: Abridge doesn’t lead with “we have AI.” They lead with “we give clinicians two hours back per day.” The AI is how. The two hours are the why. That distinction is everything, and most vendors have it backwards.

If your 2026 positioning leads with AI, you’re competing on a feature that everyone claims to have and that buyers can’t differentiate. If you lead with the problem solved and the outcomes documented, you’re competing on value. That’s the difference between a demo and a deal.

Final Thought

The through-line across all five trends is this: health plans are de-risking their vendor relationships.

Security posture is getting vetted before the first demo even happens. Solutions that plug into standardized infrastructure are winning out over proprietary silos. Buyers are asking for retention data and documented outcomes instead of roadmaps and projections. Business models need to hold up even when CMS changes direction mid-year. And the companies that have already proven they can operate at scale are the ones actually getting the contracts.

This isn’t pessimism. It’s what I’m hearing in every buyer conversation I have. The vendors who understood this in 2025 built pipeline. Those who kept pitching innovation and disruption without proof continued to watch their deals stall.

Next week, I’ll publish my five trends to watch for 2026, informed by what actually happened this year rather than what we hoped would happen. If you’re not already subscribed, now’s a good time.

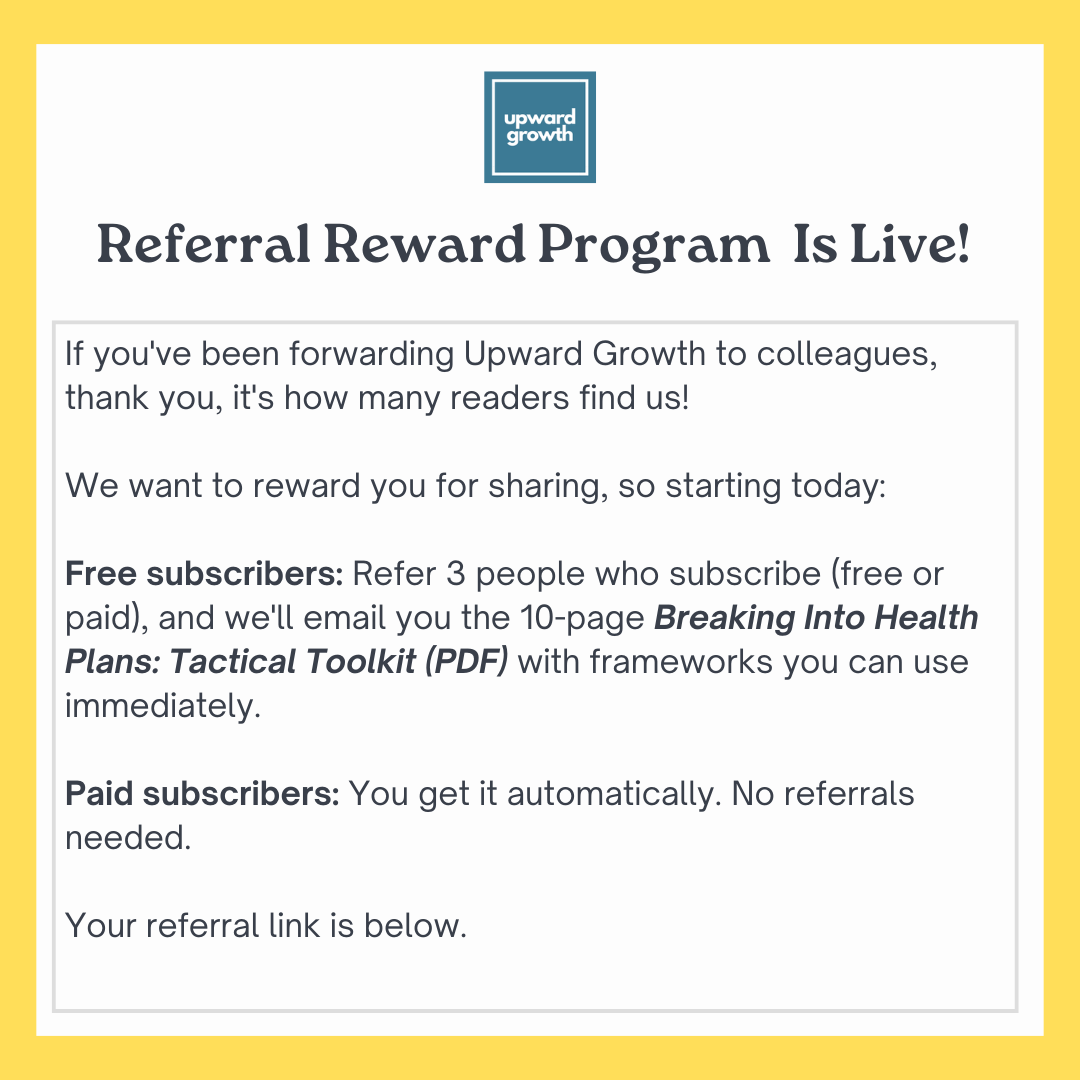

Click the button above to get your personal referral link. When 3 people subscribe using your link, I’ll email you the Tactical Toolkit.