Message Fatigue Is Costing You Deals: How Health Tech Vendors Can Win Back Health Plan Attention

When every pitch sounds the same, executives stop listening. Here’s how to stand out with clarity, credibility, and sharper positioning.

Upward Growth provides health tech leaders with the playbooks and proof to transform complex markets into real growth. Each week, we deliver clear, practical strategies on positioning, messaging, and growth, so leaders can close enterprise deals and build repeatable momentum.

📩 Join the CEOs, GTM leaders, and investors already reading every Tuesday.

💡 Sponsorship opportunities are available: Inquire here

Executives inside health plans are pitched every week by vendors whose stories all start to sound the same. Conference booths blur together. Cold emails use identical phrases. Sales decks promise outcomes that could be cut and pasted from any competitor.

After a while, health plan leaders stop parsing details and start lumping vendors together. They’re not comparing unique propositions. They’re filtering out repetition. And once they assume you look like everyone else, you’ve just become a commodity.

That’s message fatigue. It’s what happens when dozens of companies frame their value in nearly identical terms. Instead of helping buyers sort, it convinces them not to bother. Even when a product has genuine strength, it gets filtered out because the buyer can’t distinguish it from the other fifteen they’ve already heard.

And fatigue isn’t just an annoyance. It drags on every part of the sales cycle. It leads to longer internal reviews, delayed pilots, and more skepticism at the executive level. In a market where trust is already scarce, sameness compounds the risk.

This article is for health tech leaders who know their story is getting lost. I’ll break down why the problem is structural, how it erodes vendor credibility, and what it takes to cut through.

The Hidden Cost of Sameness: Why Deals Slow and Forecasts Slip

Message fatigue doesn’t just make it harder to get attention; it muddies the entire market.

Walk through a vendor hall or skim a few websites, and the patterns repeat: “end-to-end,” “gap closure,” “AI-powered.” The issue isn’t that plan executives take these words at face value. It’s that repetition makes it nearly impossible to distinguish between the vendors who truly deliver and those who don’t. Everyone starts to blur together.

The consequences hit every level. Executives waste cycles sorting substance from spin. Vendors who genuinely span the full risk adjustment cycle or apply AI in meaningful workflows struggle to prove it because ten others have already diluted the exact phrases. And companies with narrower but valuable solutions end up sounding like they’re overreaching, even when they’re not.

The result: everyone loses. Buyers become increasingly skeptical, outreach efforts can seem like noise, and sales cycles drag on as plans add more diligence steps to protect against disappointment. Strong solutions still get slowed, not because the value isn’t real, but because the category itself has been dulled by sameness.

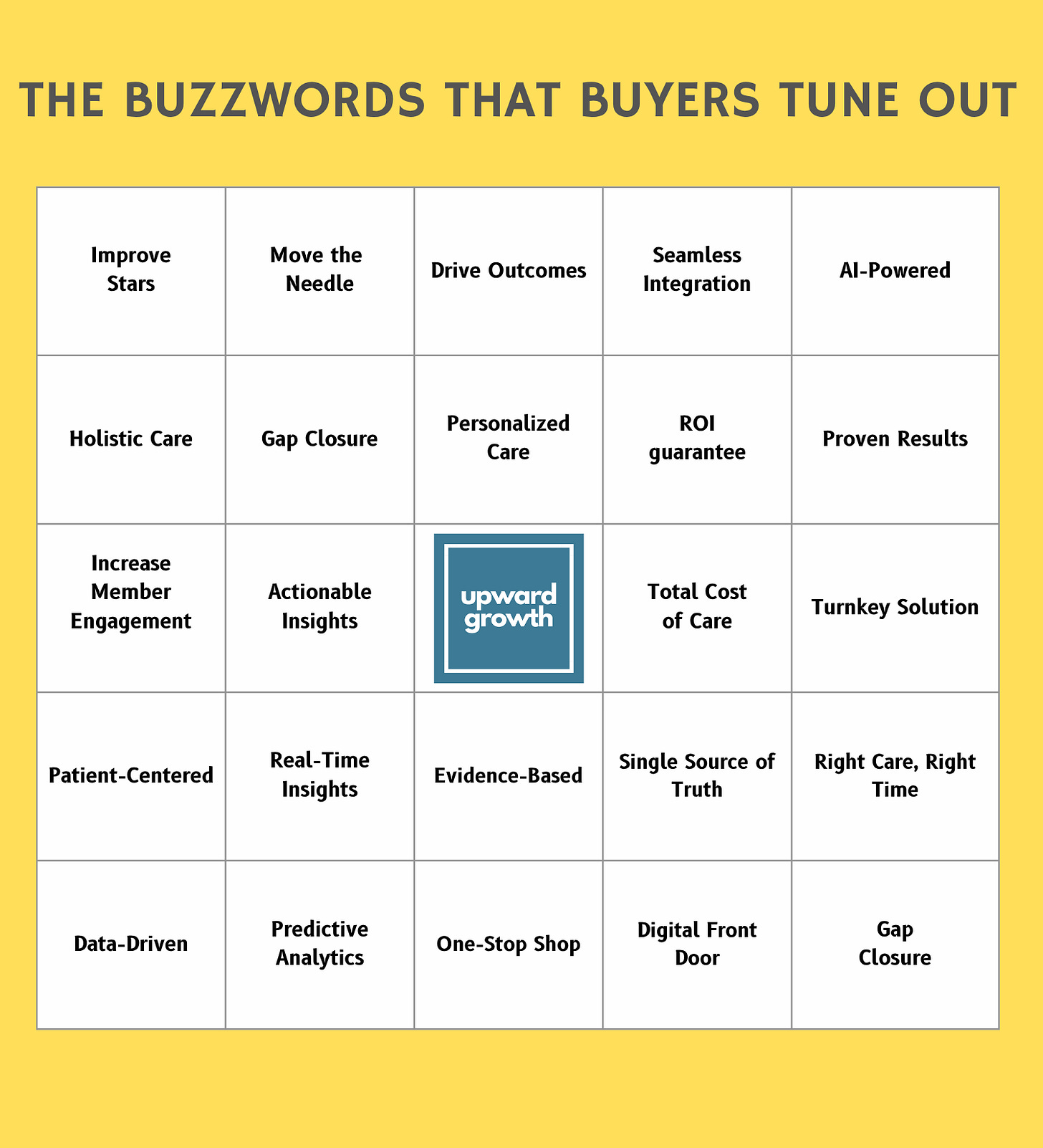

The Buzzwords That Buyers Tune Out

Executives inside health plans don’t need to guess what vendors will say. The same claims echo across every booth, email, and first-call deck. Over time, those words stop signaling capability and start signaling sameness.

Walk through a conference hall and you’ll hear them on repeat. To illustrate the point, here’s a “conference bingo card” of the phrases buyers tell me they encounter most often:

Each square on that card above reflects a claim that health plan executives can now recite from memory. The problem isn’t that these phrases are irrelevant; in fact, each phrase is something that health plans genuinely care about. Unfortunately, repetition has dulled much of the meaning of each. To see how, let’s take the most common examples and break down why they’re tuned out:

“AI-Powered”

AI has become the most abused label in health tech. Without context, it could refer to member outreach, workflow triage, or back-office automation, among other things. Each has very different implications for a plan, yet most vendors present “AI” as if the word itself creates differentiation. And because so many vendors rely solely on the word, executives do not treat it as proof of capability.

“Gap Closure”

Entire rows of booths market “gap closure.” But the scope varies wildly: one vendor closes a single high-value measure, another closes many through tech-enabled services, and a third offers more of a data handoff. To an executive scanning the floor, they all sound identical. And that’s how even the right vendor gets missed.

“End-to-End”

This phrase dominates risk adjustment, care management, and SDoH pitches. For one vendor, it means identifying at-risk members, providing nurse outreach, and closing the loop. For another, it means simply generating lists to manage the plan. Both claim the full cycle. The result is longer vetting cycles because buyers need to carry several vendors far enough along just to see who’s truly comparable.

The thread running through all of these isn’t dishonesty, but oversimplified claims that leave buyers guessing. Vendors stretch broad phrases to encompass various solutions, hoping to remain relevant to a broader range of buyers. Instead, such language reduces buyer trust and that vendor’s credibility. Lose-lose.

How Vendors End Up Sounding Alike (and Why It Hurts Sales)

No growth leader sets out to sound generic, but it often happens because of the pressures placed on growth inside their organizations.

Teams look around the market, see how the largest competitors describe themselves, and assume the safest path is to copy the phrasing. It feels lower-risk to borrow familiar language than to stake out something sharper. The result is a field of websites and sales decks that blur together, even among companies with very different capabilities.

Deadlines make the problem worse. Too often, the temptation is to edit what already exists instead of doing the harder work of tightening scope and clarifying value. And so “Good enough” messaging gets shipped and then recycled in email campaigns, booth banners, and outbound cadences until it becomes permanent.

Another force is sales optics. Many CROs are still measured by activity volume: how many leads were logged, how many meetings were booked, how many “opportunities” hit the pipeline this quarter. Vague, catch-all claims make it easier for sales reps to create opportunities, but they often result in a weak pipeline. And when those conversations quickly fizzle out, leadership chalks it up to sales execution instead of recognizing that the messaging itself is the problem.

You can see this play out during pipeline review. A rep points to six “opportunities” added last month. Two are dead on arrival because the plan was looking for services you don’t offer. A couple more limp into diligence before stalling once buyers realize your scope wasn’t what they expected. Sure, the funnel looks active, but in reality, your brand may have just been written off by multiple health plans, and that will linger long after the deals fall out of Salesforce.

And the drag doesn’t stop there. When sameness spreads across dozens of vendors, it trains plans to slow down, add more checkpoints, and lean harder on incumbents. Even differentiated solutions end up stuck in the same holding pattern, dragged down by the collective erosion of trust.

Five Moves That Separate You From the Vendor Pile

Health plan executives aren’t short on vendor outreach, but they are short on reasons to care. Too often, vendors confuse “saying more” with “saying better,” and the proof points that would actually build credibility get buried. Utilize these five structural shifts to make your message more credible, more memorable, and less likely to be dismissed.

1. State What You Don’t Do

The fastest way to earn trust is to define boundaries. If your product doesn’t cover a specific function, say so. It saves both sides time and establishes credibility. Buyers are far more likely to believe the parts you do claim when you’ve been clear about the parts you don’t. Drawing edges doesn’t weaken the story, it makes it more believable.

2. Be Precise With Language

Broad phrasing muddies the water. Replace it with detail that shows exactly where you operate. Instead of “gap closure,” name the specific gaps you close and why those gaps matter. Instead of “AI,” explain where it sits in the workflow and what measurable outcome it drives. Precision doesn’t narrow your opportunity set. It makes differentiation visible and immediately more credible to buyers who have heard it all before.

3. Equip Buyers With Portable Language

Your first meeting is never the only meeting. Champions need to carry your message into meetings you won’t be in, such as those with finance, compliance, and strategy. If they can’t explain or translate what makes your solution stand out, you’re in big trouble. Winning vendors provide portable language: one-liners, proof points, and numbers that can survive being forwarded intact and remain effective. Portability is what enables a deal to continue moving forward when you’re not in the room.

4. Build Credibility Through Partnerships

No vendor covers everything, and pretending to only undermines trust. A more effective approach is to acknowledge your limits and direct buyers to ecosystem partners. Executives remember the vendor who helped them solve their problem, even when the answer came from someone else. The credibility you gain in those moments far outweighs the false reassurance of claiming a solution you don’t actually have.

5. Treat Clarity as a Sales Asset

When buyers can instantly say, “This is the vendor that closes X gap” or “This is the solution that integrates at Y point in workflow,” you stop being compared to everyone else. Deals move faster because executives know where you fit, and they’re more confident advancing you internally. Clarity doesn’t just help you stand out. It shortens cycles, raises conversion, and positions you as the lower-risk choice.

These five shifts create a distinct market posture for your company’s message. Instead of chasing conversations with language that could apply to anyone, you’re equipping buyers with reasons to believe you specifically. And the best way to stress-test whether your current claims meet that standard is to run them through a structured audit, which is what we’ll handle in the next section.

Upgrade to a paid subscription to keep reading — including the 3-step playbook with rewrites, stress-tests, and field-ready tools that shorten cycles, sharpen positioning, and give your reps a story that travels.