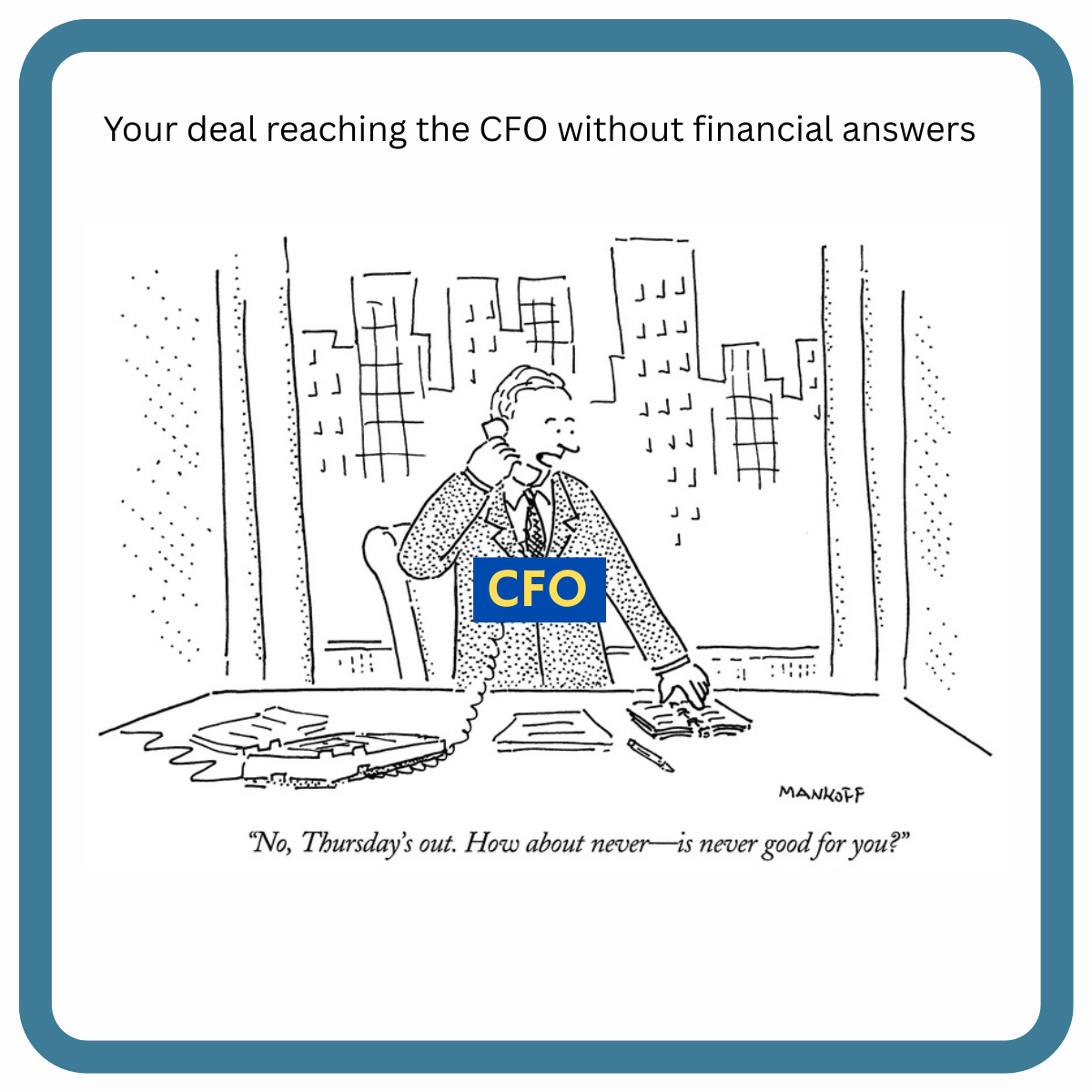

The CFO Filter: Why Your Health Plan Champion Can't Close the Deal Anymore

Your clinical champion loves your solution. Finance killed it anyway. Here's what changed, and how to fix it.

Upward Growth provides health tech leaders with the playbooks and proof to transform complex markets into real growth. Each week, we deliver clear, practical strategies on positioning, messaging, and growth, so leaders can close enterprise deals and build repeatable momentum.

🟦 Connect with the author, Ryan Peterson, on LinkedIn.

📩 Join the CEOs, GTM leaders, and investors already reading every Tuesday.

💡 Sponsorship opportunities are available: Inquire here

Health plan CFOs have quietly become the hidden gatekeepers for vendor decisions, and most vendors haven’t adjusted.

Three years ago, a strong clinical champion with solid outcomes data could move a $2M contract through approvals. Today, that same champion needs to answer financial questions they’ve never been asked before: Which budget line does this impact? When does cash flow turn positive? What happens if our MLR runs high and we need to cut discretionary spend?

Don’t get me wrong, the clinical champion still matters, and your solution’s outcomes need to be real. But more and more decisions now run through finance, and CFOs evaluate proposals differently than clinical buyers do. They want to know which budget is affected, when ROI is realized, and what happens if performance falls short of the target.

Without clear answers to those questions, even strong solutions get deprioritized. Not because they don’t work, but because the business case doesn’t survive CFO scrutiny.

Why CFOs Became the Real Decision-Maker

Across every line of business, health plans are defending profitability under sustained cost pressure that shows no signs of easing.

Medicare Advantage medical loss ratios are climbing as claims costs outpace benchmark increases. Stars bonus attainment remains volatile, with fewer contracts hitting 4+ Stars in recent years. Medicaid margins are under pressure from state budget cuts and the $1 trillion reduction in federal funding from the recently passed One Big Beautiful Bill. Commercial health plan costs are expected to rise at the highest rate in 15 years, forcing employers and their health plan partners to scrutinize every dollar of spend.

When medical costs outpace revenue benchmarks and quality bonuses become harder to secure, CFOs don’t just review budgets. They restructure how plans evaluate and manage vendors entirely. Plans are consolidating vendor relationships, cutting counts by 20 to 30 percent to simplify operations and increase procurement leverage. Board-level pressure is intensifying, with executives now expected to report operational efficiency metrics, such as cost per member per vendor category, alongside traditional financial measures. Your deal isn’t just competing with other solutions. It’s competing with “reduce vendor count and bank the savings.”

CFOs have traditionally approved large vendor contracts, but their role has evolved from validating clinical decisions to architecting procurement strategies that focus on medical cost containment and quality revenue protection. Many plans have transitioned from annual budget planning to quarterly vendor reviews tied to MLR performance and Stars attainment, continually asking whether each contract is protecting quality revenue or reducing medical expenses and eliminating anything that isn’t.

The implication for vendors is clear: traditional “clinical value” or “member experience” messaging is no longer enough. If your story doesn’t translate to financial outcomes that a CFO can defend in a budget meeting, it won’t survive internal scrutiny. Your champion may believe in your solution, but if they can’t answer finance questions with financial logic, the deal dies before it reaches contract review.

The Five Questions CFOs Actually Ask Before Funding Your Deal

CFOs evaluate vendor proposals through a different framework than clinical or operational buyers. They care about cost avoidance, budget predictability, and audit defensibility within the specific fiscal realities of health plan operations.

Here are the questions CFOs actually ask when they review vendor proposals:

“If our medical loss ratio runs higher than projected, is this solution still defensible, or does it become a discretionary cut?”

“Does this come out of medical expense, administrative cost, or quality incentive budget, and which budget owner signs off?”

“Do we see savings in the current contract year, or does ROI depend on next year’s Stars bonus, risk adjustment settlement, state rate negotiations, or employer renewal pricing?”

“What happens to our ROI if we hit 80 percent of your projected outcome, or if regulatory requirements change mid-contract?”

“Can our internal analytics team validate your results using our claims and eligibility data, or do we need to rely on your reporting?”

Clinical teams think in member outcomes and care quality metrics. Finance teams think in terms of budget categories and cash flow timing within the health plan's fiscal year. The translation gap exists because most vendors build business cases around what improves, like adherence rates or gaps closed, rather than which budget line it impacts and when the plan recovers the cost within their reporting calendar.

One quality improvement vendor made it to final CFO approval. Finance asked: “If our Stars rating drops from 4.0 to 3.5 this year, does the ROI still work without the quality bonus?” Without a model illustrating the math at lower performance, the internal champion had no way to defend it, and the deal was rejected in budget review.

The vendor mistake is speaking in care quality narratives without tying them to financial outcomes. “We improve medication adherence” or “We close HEDIS gaps faster” may resonate with clinical teams, but those claims don’t answer what a CFO needs to know: what it costs, what it saves, and when the plan sees the return. Without that translation, even strong clinical proof becomes financially unconvincing.

Understanding what CFOs ask is one thing. Answering those questions in language they can defend is another. That’s where most vendors fall short.

From Clinical Claims to CFO Language: Four Reframes That Work

Translating clinical outcomes into CFO language isn’t about dumbing down your solution. It’s about connecting what you improve to the budget lines health plans use to evaluate every dollar they spend.

Consider this example of a risk adjustment vendor repositioning their value proposition after repeatedly losing proposals in finance reviews. Originally, they led with: “We improve documentation accuracy and capture missing HCCs through chart review.” That’s clinically accurate but financially vague.

After the stall, they rebuilt their pitch: “We protect $18M in annual risk revenue for a 400K-member MA plan by identifying undocumented chronic conditions in existing charts. Based on our last three projects, plans capture an average of 0.14 RAF points per member, translating to roughly $140 per member in additional revenue.”

Now that’s quite the difference!

But let’s be clear, the difference wasn’t the clinical mechanism. What changed was anchoring the outcome to a revenue line the CFO already forecasts, quantifying the operational lift, and showing when the investment pays back.

The pattern is consistent: start with what you improve clinically, then connect it to a budget line that the CFO already tracks (medical expense, quality bonus, or penalties avoided), quantify the outcome in dollars, and clarify when the plan sees a return. That’s how clinical proof becomes financial logic.

Here are three more examples of similar translation:

Clinical claim: “We improve medication adherence for high-risk members through personalized outreach.”

Finance translation: “Reduce avoidable hospitalizations by 8 percent among diabetic and cardiac populations, avoiding roughly $500K annually in medical costs for a 50K-member MA plan. Prior projects improved medication adherence by 11 percent, directly reducing admission rates within the following quarter.”

Clinical claim: “We close HEDIS gaps faster than manual outreach through predictive modeling.”

Finance translation: “Secure $2M in Stars bonus revenue per contract by identifying and closing measure gaps 90 days earlier in the measurement year. Three regional plans using our platform moved from 3.5 to 4.0 Stars in year one, protecting quality incentive payments worth roughly $80 PMPM.”

Clinical claim: “We reduce emergency department overutilization through 24/7 nurse triage.”

Finance translation: “Redirect 240 low-acuity ED visits per 10K members annually to appropriate care settings, avoiding $300K in unnecessary ED costs. The program cost is under $100k per year, and no IT integration is required, and it is ROI positive within the first contract year.”

Beyond the base case, anticipate what happens if performance falls short of the target. If your ROI depends on closing 500 gaps, show what happens when you close 350. If your pricing scales with population size, explain how unit economics hold at smaller cohorts. CFOs don’t expect you to hit 100% of the target, but they do expect you to show why the math still works at 70%.

Plans fund vendors who’ve done this work upfront. They cut vendors who make CFOs reverse-engineer the business case themselves.

“CFOs don’t expect you to hit 100% of the target, but they do expect you to show why the math still works at 70%.”

Understanding how CFOs evaluate vendors and learning to speak their language is the first step. The harder question is: what specific assets do you need to build, and how do you change your sales motion to engage finance from Day 1 instead of treating them as a final hurdle?

The rest of this article walks through the three assets CFOs actually use to validate deals, how to build them without a finance background, and the new deal sequence that assumes CFO scrutiny from the first conversation. Upgrade to paid to keep reading.