The Total Addressable Market (TAM) Trap

How Misunderstanding Your Market Size Derails Growth Before It Starts

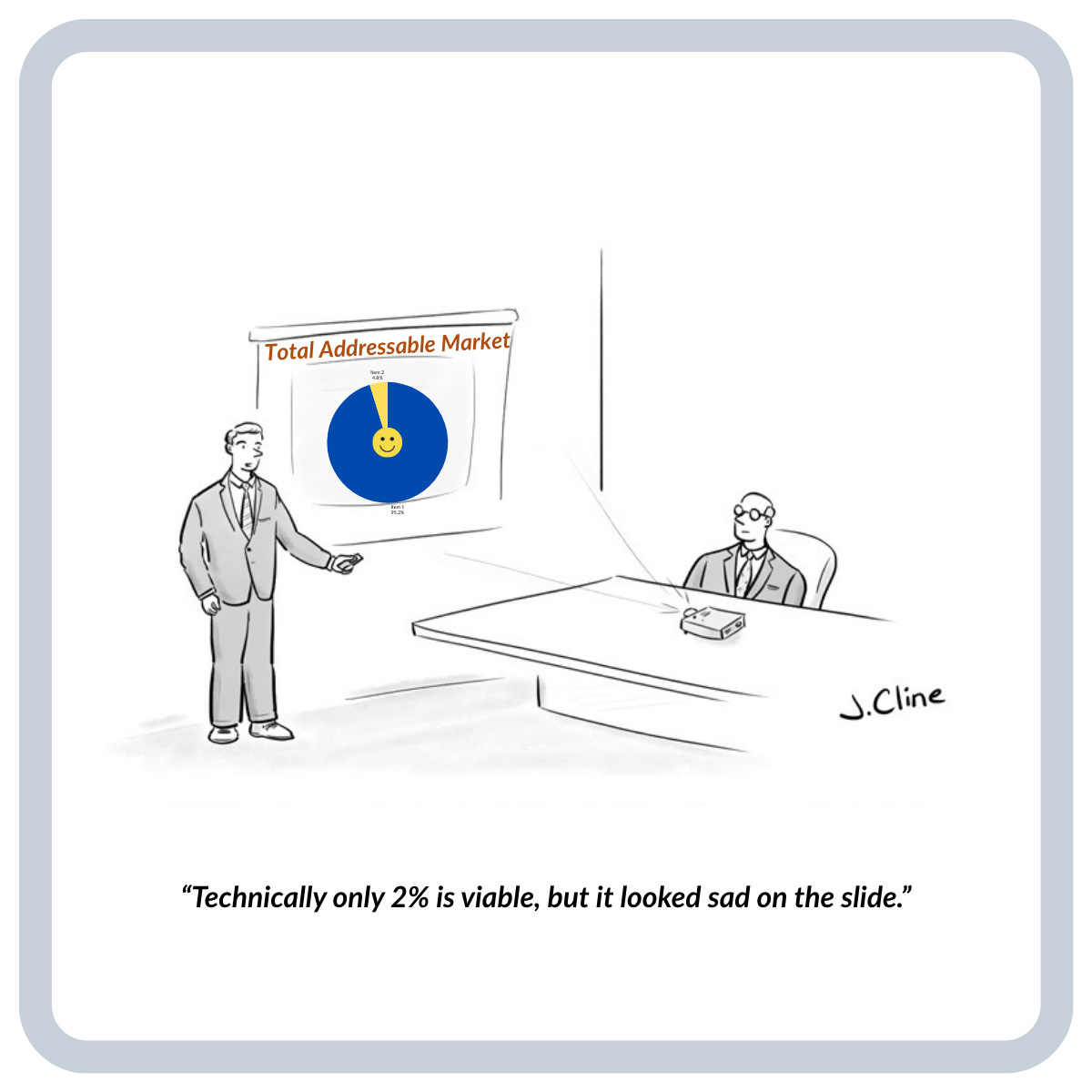

The Part of the Pitch Everyone Pretends to Believe

It typically shows up around slide four of the PowerPoint deck. Just after the polished summary of the team and a handful of business highlights, the bold Total Addressable Market (TAM) figure appears: “We serve a $42 billion market.”

The problem is, the person across the table isn’t buying it (literally or figuratively). If they’re an investor, they’ve seen a version of this same slide twice already this week. If they’re a health plan executive, they have no interest in hypotheticals. In both cases, the reaction is the same: mental disengagement and a quiet assumption that this health tech vendor really doesn’t understand the market.

TAM mistakes tend to signal something broader: a leadership team that hasn’t fully thought through where growth will actually come from, or how it maps to procurement behavior, segment structure, and buyer readiness. Once that gap is exposed, everything else (product roadmap, GTM model, revenue projections, etc.) is often viewed through a more skeptical lens.

Part of the problem is that investors expect a big number. Boards look for signs of scale. And executives often inherit pitch templates where the TAM has already been inflated. Everyone in the room understands the figure is more symbolic than precise, but few want to be the one who dials it down. So the pattern repeats.

This piece breaks down why most TAM stories collapse under scrutiny, how stronger teams define the market they're truly equipped to win, and what a sharper sizing narrative unlocks for leadership alignment, sales focus, and investor confidence.

Where the Story Starts to Break

The issue isn’t the size of the number. It’s what the number implies about how your business expects to grow.

A Total Addressable Market (TAM) slide is meant to frame opportunity. But in most decks, it unintentionally reveals a lack of fluency in how market access actually works, especially in healthcare, where buyer behavior, funding flow, and segmentation make the market less open than it looks on paper.

Here are three signals that reveal to the room that your TAM hasn’t been pressure-tested.

1. Modeling TAM by line of business without qualifying for buyer behavior

This version starts with a big, familiar number: the total number of Medicaid or Medicare Advantage members nationwide. From there, it multiplies by an assumed per-member revenue figure and calls it addressable. What it misses is that not all plans within a line of business are equally accessible. Procurement pathways, regional variation, contracting authority, and vendor openness vary widely. A vendor with traction in regional Medicaid plans cannot assume the rest of the market will look the same.

2. Modeling TAM by disease prevalence

This is especially common in markets such as Musculoskeletal (MSK), diabetes, behavioral health, and maternal care. The vendor calculates the number of individuals with the condition and builds TAM off a hypothetical per-member revenue value. But plans don’t budget around disease burden; they budget around performance targets and strategic gaps. Prevalence alone doesn’t indicate priority. A sharper model isolates the subset of buyers actively investing in outcomes tied to that condition, with available budget and aligned incentives.

3. Modeling TAM by adjacent buyer type without evidence of access

This happens when a vendor succeeds in one segment (say, Medicaid plans) and tries to expand TAM by including adjacent markets like Medicare Advantage or SNPs. The logic assumes that if the product works in one vertical, it can scale to others with similar populations or workflows. But each line of business comes with its own regulatory constraints, contracting structures, and political dynamics. Unless the team has already established access into those segments, that portion of the TAM remains theoretical.

TAM Isn’t About the Number. It’s About the Narrative

The best TAM slides don’t exist to impress. They exist to clarify.

They help investors understand how the company earns market share, how the growth motion aligns with buyer behavior, and what conditions make the market viable now, not eventually. They demonstrate that the leadership team operates with a clear understanding of where demand resides and how it translates into predictable revenue.

A sharper TAM story doesn’t mean shrinking the market. It means showing what part of the market is currently accessible and how the company will unlock the rest. That might include geographic expansion, regulatory shifts, line-of-business sequencing, new product development, or M&A. The best teams do not hide this logic. They share it.

For example, a vendor supporting condition-specific outreach might define its initial TAM as the set of Medicare Advantage plans managing duals or chronic condition enrollees, operating in states with HEDIS-aligned incentive programs and a track record of delegated vendor partnerships. From there, the expansion story could include Stars-aligned outreach support, care gap closure infrastructure, or member activation programs across additional populations. Same platform, sequenced access.

The point is not to sound conservative. It is to sound precise. A TAM that reflects today’s market dynamics and maps directly to how the company sells is more likely to build conviction than one that simply gestures at category scale.

How to Build a Smarter TAM Model

There’s no universal formula, but there is a pattern to the most accurate models. The best rely less on theoretical needs and more on observable behaviors, such as buyer intent, procurement access, and current budget availability. They also tend to follow five principles:

1. Treat TAM as a planning tool, not a headline.

Your market definition shapes how your team spends its time. It determines what pipeline looks qualified, what product roadmap features get prioritized, and where you deploy capital. A clear TAM improves both discipline and your message.

2. Anchor your model to how you’ve actually sold.

If your company has closed ten $200,000 deals with regional Medicare Advantage plans, your TAM should start by identifying how many similar buyers exist. Start by defining TAM by product scope, contracting behavior, and use of delegated vendors. It will feel limiting at first, but it demonstrates you truly understand where momentum lives and what positioning work you may still need to do. (For teams struggling with that positioning clarity, read my article Positioning Comes Before Growth to help with the upstream work that needs to happen to make TAM and scaling convos more effective).

3. Define addressable as what’s budgeted.

Sure, plenty of organizations should be using your solution, but that doesn’t make them part of your market. Smart TAM models screen for accounts with available budget, relevant incentive pressure, and a credible contracting path. Need is the starting point. Budgeted intent is what makes the account real.

4. Reflect access advantages, not just eligibility.

If your team has existing contracts, known procurement status, or executive credibility within a channel, bake that into the model. Two companies targeting the same buyers do not have equal access. Your TAM should reflect what gives you a shorter path to revenue.

5. Sequence expansion instead of baking it in.

Finally, one of the biggest mistakes is the need to justify that your product can support six verticals or five personas. Instead, you need to show how you’ll earn your way into each one. Start with where you already win. Then, demonstrate how product depth, buyer adjacency, or regulatory tailwinds can unlock the next segment. That sequencing logic should be visible in the TAM narrative itself.

Final Thought

A strong Total Addressable Market (TAM) story does more than just size the market; it creates a narrative that reflects how a team makes decisions. It indicates whether they understand which parts of the market are truly accessible, what conditions support revenue growth, and how their strategy aligns with buyer behavior. It also signals whether they’re building toward expansion with intent or simply listing every possible direction they could grow.

Teams that define their market with precision aren’t playing small. They’re demonstrating that they understand where real traction is possible, what it will take to achieve it, and how they intend to build on that growth. That level of clarity isn’t just strategic. It’s investable.

🔒 Like This? Upgrade to a paid Subscription.

The free newsletter covers the big ideas. Paid subscribers get the full breakdowns, including client-tested strategy, behind-the-scenes examples, and deeper thinking you won’t find anywhere else.

→ [Become a Paid Subscriber]

About the Author

Ryan Peterson writes Upward Growth, where he shares practical insights on selling health tech into the payor market. With 15+ years in healthcare growth leadership, he focuses on helping vendors translate their value into traction with health plans.

🟦 Connect with him on LinkedIn.