Why Most Health Tech Partnerships Don't Generate Pipeline (And What Actually Works)

How to recognize when a partnership will generate pipeline vs. when it's compensating for weak positioning

Upward Growth provides health tech leaders with the playbooks and proof to transform complex markets into real growth. Each week, we deliver clear, practical strategies on positioning, messaging, and growth, so leaders can close enterprise deals and build repeatable momentum.

🟦 Connect with the author, Ryan Peterson, on LinkedIn.

📩 Join the CEOs, GTM leaders, and investors already reading every Tuesday.

💡 Sponsorship opportunities are available: Inquire here

The partnership announcement arrives in your inbox:

“We’re excited to announce our strategic partnership with [Other Vendor]. Together, we’ll deliver integrated solutions that transform care delivery and drive better outcomes for health plans nationwide.”

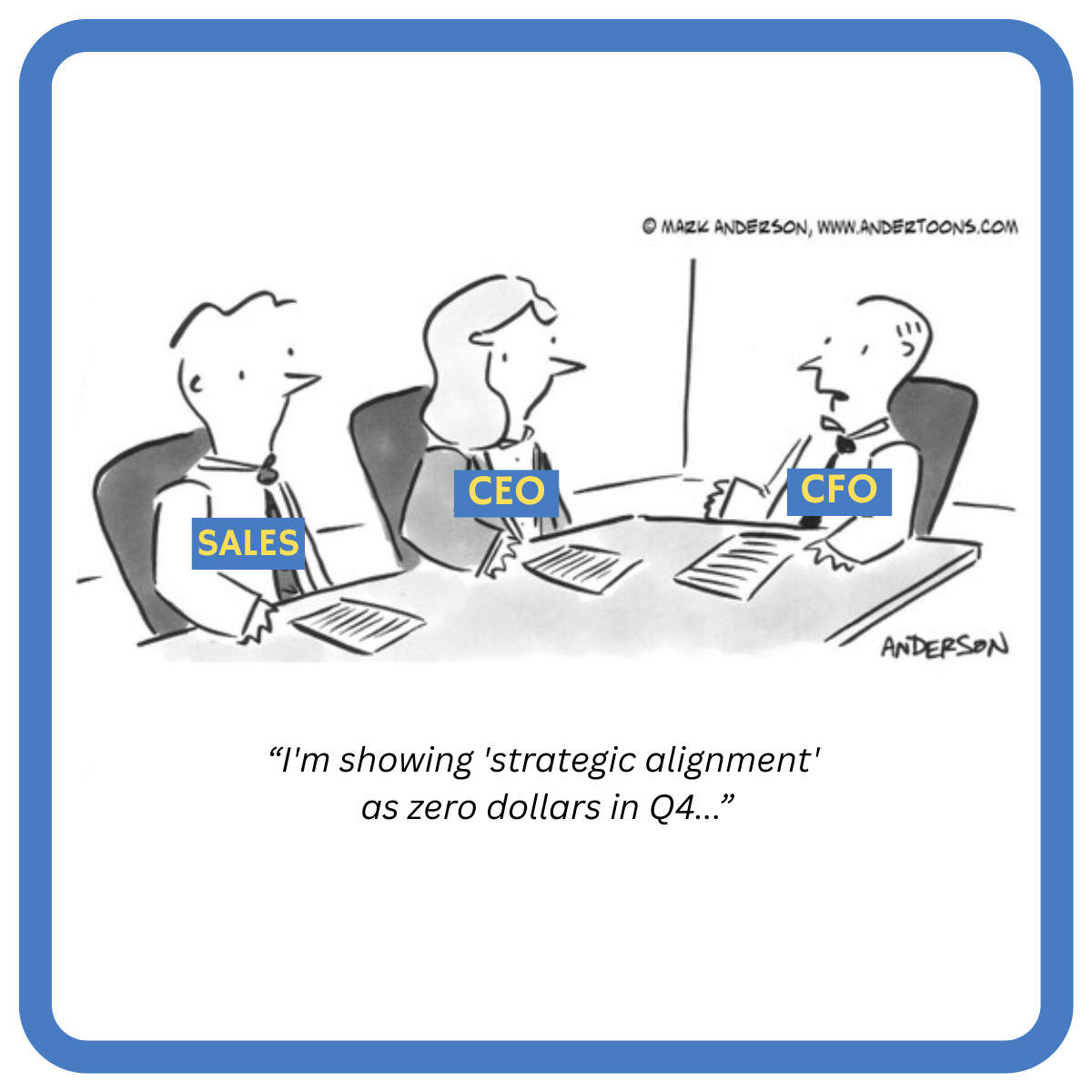

The conversation usually takes place at a conference such as HLTH, AHIP, or RISE National. Two CEOs realize they’re both selling to health plans. One says, “We should introduce each other to our customers.” The other agrees immediately. Both leave the conversation feeling like they just solved their Q4 pipeline problem.

Six months later, the partnership has generated zero pipeline, both sides are quietly frustrated, and no one wants to admit it’s not working. It’s not a failure of effort or intent. It’s that the structural conditions required to make partnerships work are harder to create than most vendors realize when they’re signing the agreement.

The partnerships that work have clear structures: explicit roles, documented terms, and consistent closed deals. If you’re spending more time on partnership marketing than on defining how it actually functions, you’re focused on the wrong thing.

This article explains why most partnerships fail to generate pipeline, the four conditions that working partnerships share, and how to evaluate whether your current partnership is worth continuing. We’ll start with the two most common partnership models vendors try and why they struggle to produce results.

Two Partnership Models Most Vendors Try (And Why They Rarely Work)

The Mutual Introduction Model

This is the most common partnership structure: two vendors with similar-sized customer bases agree to introduce each other’s solutions to their respective clients. The premise is simple: you have relationships I don’t; I have relationships you don’t, so let’s share access.

Let’s go back to the earlier scenario. Two vendors meet at a conference. Both have 15-20 customers. Both believe their clients would benefit from the partner’s product. It’s pretty straightforward. You introduce each other to half your customers, close a few deals each, and suddenly you’ve added revenue without hiring more sales capacity.

I’ve rarely seen this model generate meaningful pipeline. The breakdown happens when both sales teams are already managing their own quotas. Your VP of Sales is three deals short with six weeks left in the quarter. The idea that she’s going to learn another product, run someone else’s demo, and split commission on a deal? That’s not getting prioritized. (Meanwhile, the partner’s team is in a similar situation, too.)

Neither side consistently generates introductions because no one’s compensated for them. Referral fees don’t hit comp plans. There’s no quota credit for partnership-sourced deals. Both CEOs assume their counterpart will drive activity. Six months in, the score is zero intros, zero meetings, zero pipeline.

The problem isn’t laziness. It’s economics. A 10 percent referral fee doesn’t move the needle when your AE is $400K behind quota with four deals in late-stage pipeline.

Partnership activity gets deprioritized because the incentives don’t support it.

The Distribution Partnership

In this model, an emerging vendor partners with an established incumbent to gain access to enterprise distribution. The incumbent gets to claim innovation without building internally. The emerging vendor gets a recognized brand name and hopes their partner’s sales force will actively sell their solution.

The setup is familiar: a large incumbent watches a startup solve a problem adjacent to their core offering. Rather than compete, they partner. The logic holds for both sides. The incumbent addresses a board concern without internal investment, and the startup gets a recognizable logo and imagines unlocking enterprise distribution.

The challenge here shows up in prioritization. The incumbent’s existing revenue is stable and predictable. The partnership is a strategic hedge, not a growth imperative. Meanwhile, the emerging vendor invests heavily (by building custom integrations, running joint pilots, and attending internal planning meetings), while the incumbent’s product team moves slowly and its sales organization focuses on protecting existing accounts.

The incumbent’s sales team has little reason to actively sell the partner’s product. It’s not in their comp plan. It doesn’t count toward quota. In many cases, it requires explaining something new to buyers who are already satisfied with the incumbent’s offering. The partnership becomes a nice-to-have rather than a priority.

Large incumbents announce partnerships constantly because it’s faster than building and less risky than competing directly. But unless there’s explicit quota credit, contractual pipeline targets, or executive compensation tied to partnership success, it won’t get prioritized when it competes with core business.

These two patterns fail for different operational reasons, but they share an underlying problem.

The Real Problem: Partnerships Don’t Fix Weak Positioning

If you’re struggling to explain your value on your own, adding another company to the story won’t help. You’re hoping someone else’s customer relationships or brand recognition will compensate for the positioning work you haven’t done yet.

The pattern is consistent across all partnership types: partnerships don’t fix weak positioning. They expose it. Whether it’s two smaller vendors hoping mutual introductions will solve their pipeline problem, or a startup hoping an incumbent’s brand will validate their solution, the underlying issue is the same. The partnership is substituting for the hard work of clarifying your message, proving your model works, and building a repeatable sales motion.

Partnerships add to a strong go-to-market motion.

They don’t substitute for one.

If you can’t explain how you solve it independently, bringing in a partner just gives them more to scrutinize and more reasons to delay a decision.

The vendors who build successful partnerships do it after they’ve proven they can sell on their own. Partnerships add to a strong go-to-market motion. They don’t substitute for one.

Four Conditions Working Partnerships Have

Four conditions separate partnerships that generate pipeline from those that stall. Most failing partnerships are missing at least two.

1. Real customer overlap (not theoretical). You can name specific accounts where both products could be deployed or where one company has documented executive relationships and the other solves a different pain point for the same buyer.

One care navigation vendor and a benefits administration platform (let’s call them CareNav and EnrollTech) validated overlap before signing anything. They compared account lists and found overlapping accounts where one had executive access and the other had a relevant solution. That’s real overlap.

2. Refined roles with one lead generator and one closer. One company owns demand generation with specific commitments. The other owns conversion. Both know exactly what they’re accountable for.

EnrollTech made introductions during enrollment conversations when buyers asked about ongoing engagement. Clean handoff to CareNav, who ran discovery and closed. No joint demos and no confusion about who owned what.

3. Independent sales proven before partnering. Both companies have predictable sales motions and growth trajectories that don’t depend on partnership activity.

CareNav and EnrollTech both had strong standalone businesses before partnering. The partnership expanded its reach, but neither needed it to survive.

4. Contractual terms documented upfront. Pipeline commitments, revenue splits, customer ownership, renewal rights, and payment terms are clear before the first introduction happens.

CareNav and EnrollTech documented everything upfront: referral fees, payment terms, customer ownership, and minimum introduction thresholds. Clear terms meant no conflicts when revenue appeared.

These four conditions don’t guarantee success, but partnerships missing two or more rarely generate meaningful pipeline. The question is whether your partnership has them, and if not, whether it’s worth fixing or walking away from.

Upgrade to a paid subscription to keep reading — including the diagnostic to evaluate your current partnership, the full operational breakdown of how CareNav and EnrollTech structured their partnership to generate consistent pipeline, and how to tell if your team is actually incentivized to make it work.